Central bank bumps up rates in 'mini-tightening'

China will likely tighten monetary policy next year while increasing policy flexibility to ensure sufficient credit supply and to prevent overtightening from hurting the economy, economists said on Thursday after the US Federal Reserve rate hike.

The People's Bank of China, the central bank, raised the rates of seven-day and 28-day reverse repo agreements (through which the central bank provides money to the market) and the rates of the medium-term lending facility and standing lending facility (monetary tools to adjust money supply) by 5 basis points on Thursday.

The PBOC's rate hikes, seen by some economists as a "mini-tightening", came hours after the Fed hiked the United States' benchmark interest rate by 25 basis points to a target range of 1.25 percent to 1.5 percent in the Fed's third rate hike this year.

The PBOC called the rate rise a "normal market reaction" to the Fed's hike, and said it reflected supply and demand in the money market.

Economists said they think China's central bank will continue with a tightening bias and some forecast it will raise benchmark rates in 2018.

"On the global level, the era of a loose and accommodative environment has come to an end and major central banks have tightened monetary policy. China is very unlikely to go against the trend," Qu Tianshi, an economist at ANZ Group. China's tightening pace will be gradual and the resilient growth can afford it, Qu said.

While economists generally agree that a tightening bias will likely set the theme next year, they are divided on which tools the PBOC may use to guide market interest rates and maintain an appropriate level of credit supply.

Robin Xing, chief China economist at Morgan Stanley, predicted it may raise the benchmark interest rate in the third quarter next year and make an additional hike in the first quarter of 2019.

But some investors and economists expressed concern about the risk of overtightening given slower growth prospects next year.

"We think ... China is unlikely to hike its benchmark interest rate as the high debt level is still the key hurdle, and the use of money market rates could serve the purpose of battling leverage better," said Tommy Xie Dongming, an economist at OCBC Bank.

Oswald Chan in Hong Kong contributed to this story.

Today's Top News

- Green, beautiful, livable cities call for modernized urbanization path: China Daily editorial

- Urban renewal beyond economic growth

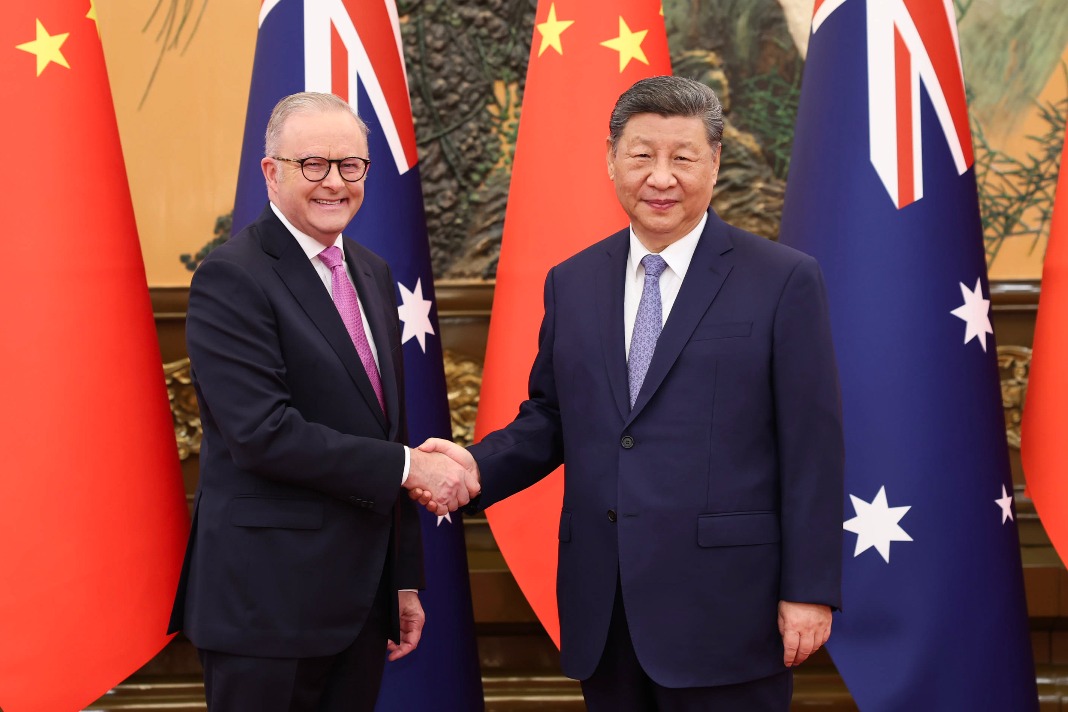

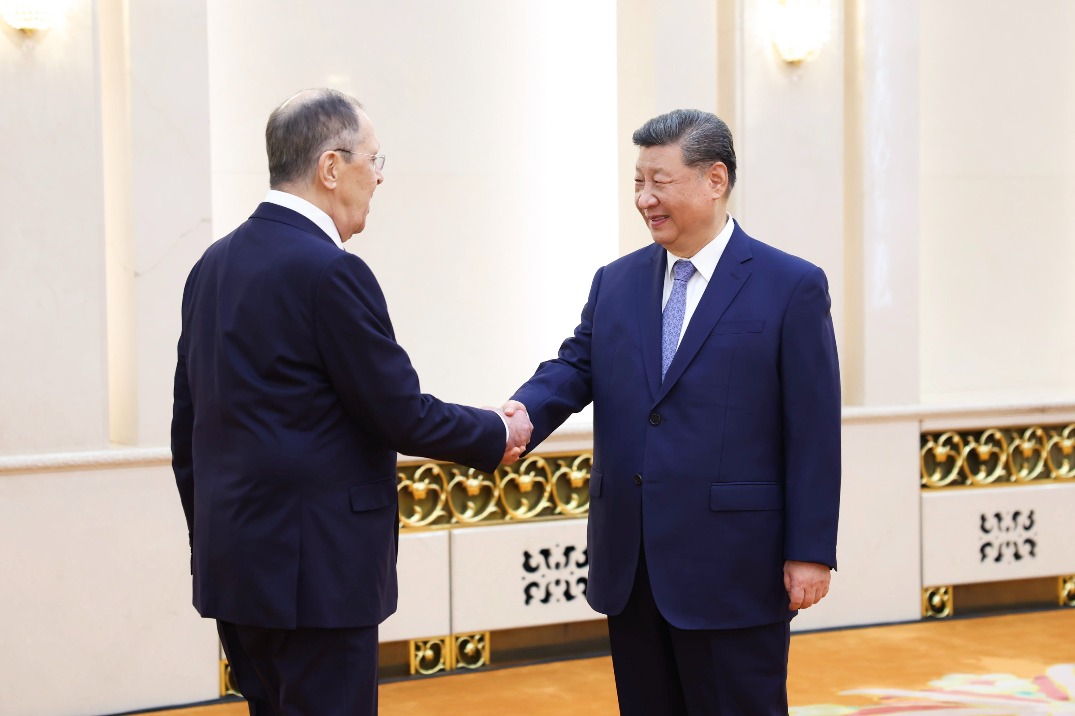

- Xi meets Russian FM in Beijing

- Xi meets heads of foreign delegations attending SCO council of foreign ministers meeting

- Xi addresses Central Urban Work Conference, listing priorities for urban development

- China reports 5.3% GDP growth in H1