Risk prevention a priority

Bad loans, property bubbles must be handled, financial expert at CPPCC says

Financial risk prevention will continue to be a tough task this year, requiring joint efforts to "hold the bottom line", especially by controlling the overall money supply and keeping a close eye on property bubbles, a national political adviser said on Sunday.

Yang Weimin, deputy head of the Office of the Central Leading Group on Financial and Economic Affairs, identified the financial system as "the most important area" for fending off risks. He called for measures to control total money supply and monitor credit growth.

"Loopholes in the financial regulatory system should be fixed, meaning tighter financial regulation compared with the past," said Yang, who is a member of the National Committee of the Chinese People's Political Consultative Conference.

The country's fast growth in bank lending, of which a part has boosted asset prices instead of supporting manufacturing production or the growth of the real economy, has lifted the leverage level and fueled economic instability, sparking concerns among political advisers when they meet in Beijing during the annual session of the top political advisory body.

Potential financial risks also could be triggered in other areas, including the property market, thus several coordinated policies are needed, Yang said.

"A new housing system and a long-term mechanism are necessary to stabilize the property market," he said. "The property market has bubbles, but the bubbles can neither be pricked nor continually inflated. Legislation is needed to develop a healthy property market, but the process could be long."

In terms of monetary and financial regulatory policies, political advisers expect to hear more from the annual Government Work Report, which is scheduled to be presented on Monday.

Some analysts expect that with stability remaining a key government objective, policymakers will remain keen to see growth of credit slow moderately.

At a group discussion of the CPPCC National Committee on Sunday, Hu Xiaolian, chairwoman of the Export-Import Bank of China and former vice-governor of the People's Bank of China, the central bank, said that although Chinese commercial banks now are under pressure from nonperforming loan growth, credit supports on the real economy, especially for small and medium-sized companies, cannot be weakened too much.

The growth rate of broad money supply, or M2, which covers cash in circulation and all deposits, was up 8.6 percent year-on-year in January, compared with a historic low of 8.2 percent by the end of December. Yuan-denominated loans increased by 12.7 percent last year, according to data from the central bank.

chenjia@chinadaily.com.cn

?

- Chang'e 6 samples show moon's asymmetry

- Vice-premier calls for more efficient policy implementation

- Top political adviser urges sustained pairing assistance to Xinjiang

- Top legislator stresses high-quality legislative work

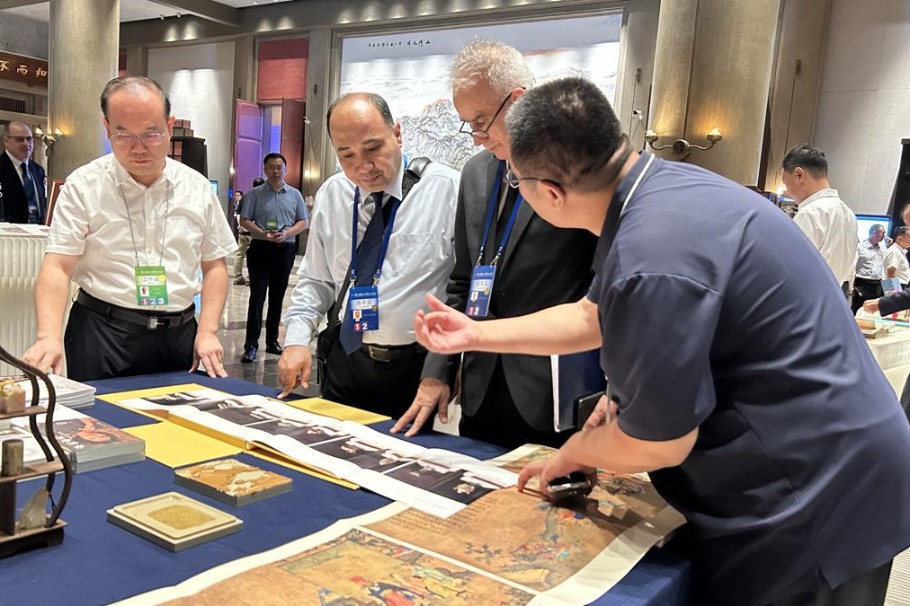

- Global representatives hail Shanghai's achievements

- National health body bans use of LVA surgery to treat Alzheimer's