Financial institutions showcase services

Many booths highlight offerings to aid cross-border business

Amid the consumer goods, eye-catching planes and large machines on display at the China International Import Expo, many overseas financial institutions are showcasing services sector offerings in response to Shanghai's role as China's financial hub and a rising global financial center.

Audit and accounting firm EY has extended its business portfolio to financial services, digital strategy and legal services. To attract more clients in China, EY is demonstrating technological innovations in artificial intelligence, automation and blockchain at the ongoing expo in Shanghai.

"There will be sufficient communication between consumers, exhibitors, buyers and governments at the expo, which will be beneficial to all," said Walter Tong, EY Greater China's key accounts leader. EY was the first company to sign up for next year's expo.

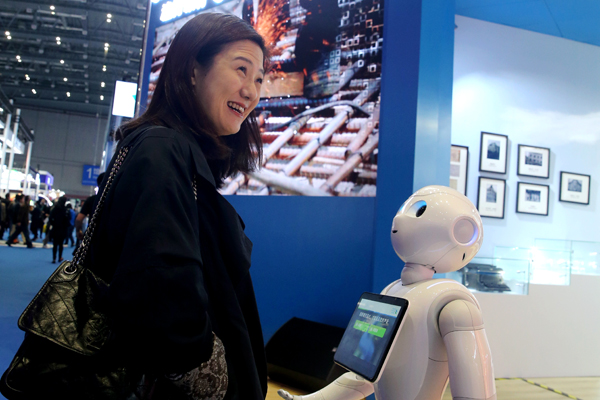

Robots that target money laundering and ways to enhance financial service efficiency are the highlights at the booth of another audit and advisory company, Deloitte.

Dora Liu, Deloitte China's innovation leader, said the company came up with the products in response to technological developments in the financial industry.

"Cross-border and cross-industry ecosystems have risen with the new technologies," she said. "Cooperation has thus become a must for the global financial industry."

Shanghai has always been the heartland for overseas banks in China. The total assets of overseas banks in the city topped 1.53 trillion yuan ($220.8 billion) by the end of June, up 12.6 percent year-on-year, according to the Shanghai Bureau of Statistics. They account for 10.2 percent of total assets in the Shanghai banking industry, well above the national average of 2 percent.

Bank of East Asia, headquartered in Hong Kong, is demonstrating its cross-border financial services including overseas accounts, settlement and financing, targeting outbound public utility and pharmaceutical companies.

"Cross-border financial services are crucial to outbound Chinese companies and overseas companies tapping into China," said Lam Chi Man, CEO of BEA China. "CIIE will be the best chance for overseas banks and financial institutions to showcase their latest achievements in this regard."

British bank Standard Chartered, which entered Shanghai 160 years ago, is supporting companies' import businesses with services covering short-term trade financing, cross-border finance matchmaking, overseas exchange risk management, and regional risk management.

"We will support the flow between goods, services, people, capital and information," said Zhang Xiaolei, president of Standard Chartered in China. "In this sense, we will also support China's economic transformation and consumption upgrading, as well as bilateral and multilateral trade all over the world."

The Shanghai government released 100 detailed further opening-up policies in July, 32 of which focus on the financial sector. As a result, the approval time for some over-seas banks' new businesses in Shanghai has been cut from three months to three weeks.

"The opening-up policies are huge encouragement to overseas banks," Zhang said. "Financial industry practitioners can thus come up with more innovative products and services. We will also be able to cooperate with Chinese banks, which will be mutually beneficial."

At HSBC's booth, the bank's global network helps it demonstrate its cross-border financial services, which are especially popular among outbound Chinese businesses and individuals studying, working or traveling overseas.

"Once driven by exports, China has now transformed to an economy buoyed by domestic consumption," said Richard Li, executive vice-president of HSBC China. "It is certain that the country's outbound economy and trade will be more active and balanced."

Singapore's United Overseas Bank has a booth in the expo's Singapore Pavilion, which was organized by the Singapore Business Federation. It showcases the bank's comprehensive financial products and services to assist more Chinese companies in their expansion into the region, as well as regional companies' expansion into China.

Citibank from the United States is introducing its financial products and services catering to the commodity and services trades. It is also holding a special roundtable meeting to explore the possibilities of introducing more trade businesses from overseas to Shanghai.

"The purpose is to better help the economic growth in Shanghai and make our contribution to the city as it is evolving into an international financial center," it said.