Trade deal hope not enough for impatient Wall Street

While a top White House economic adviser said Apple's sales prospects should improve if the US and China settle their trade dispute, Wall Street wasn't so forgiving on Thursday.

Apple's shares — and the broader market — took a pounding a day after CEO Tim Cook said in a letter to shareholders that the company would miss its revenue expectations for the fiscal first quarter. The stock had fallen almost 8 percent after hours on Wednesday.

The Cupertino, California, iPhone maker saw its shares drop $15.73, or 9.96 percent, to $142.19 on the Nasdaq Stock Market. And it was the tech-heavy Nasdaq that suffered the largest drop among the three major indices, falling 202 points or 3 percent to 6,463.50.

The Dow Jones Industrial Average shed 660 points, or 2.8 percent to 22,686. The S&P 500 was off 62 points, or 2.5 percent to 2447.89.

A report from the Institute for Supply Management (ISM) showed American factory activity recorded its largest decline since October 2008, during the financial crisis. The ISM purchasing managers index, while still showing expansion, fell to its lowest level in more than two years.

"If we have a successful negotiation with China, then Apple's sales and everybody else's sales will recover," White House Chairman of the Council of Economic Advisers Kevin Hassett told CNN.

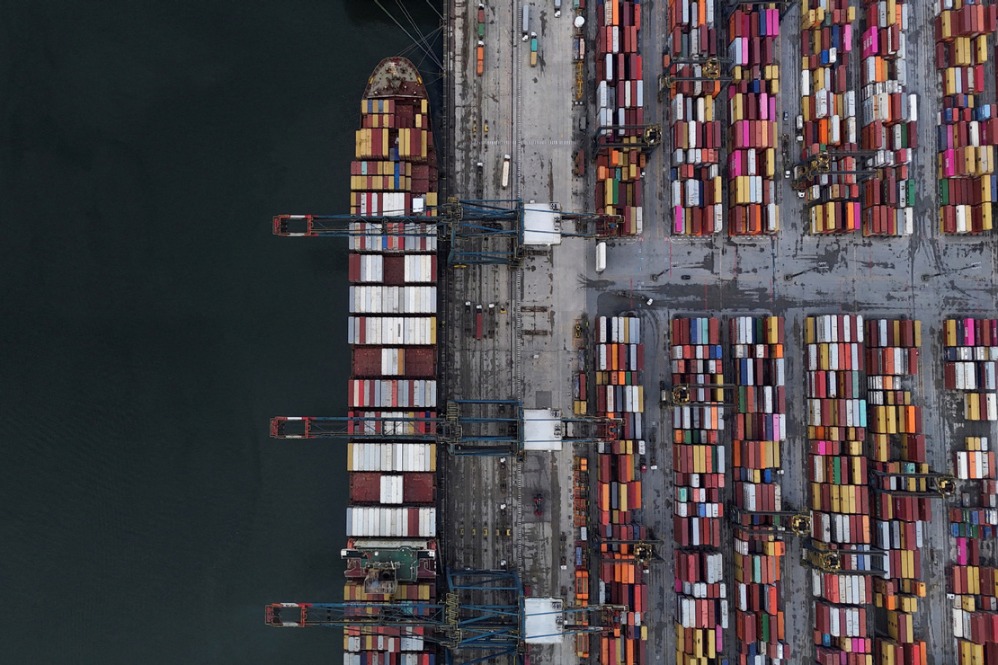

Hassett said Asian economies have been slowing and that China is "feeling the blow" of US tariffs.

"That is having an impact on earnings, and it's not going to be just Apple," Hassett said. "I think there are a heck of a lot of US companies that have a lot of sales in China that are basically going to be watching their earnings be downgraded next year until … we get a deal with China."

Don Reisinger, in a piece on Fortune.com, saw Apple's woes in China as partially self-inflicted.

"Apple appears to be tone deaf on price. Like it or not, the iPhone is really expensive. And in China … the company's decision to price its iPhones so high makes its handsets far less appealing," he wrote.

A team of US officials is expected in Beijing for trade talks on Monday, according to bloomberg.com, which reported that Deputy US Trade Representative Jeffrey Gerrish will lead the Trump administration's team, which will also include Treasury Under-Secretary for International Affairs David Malpass.

Chinese Ministry of Commerce spokesman Gao Feng confirmed on Thursday that the two sides would meet, although he didn't provide a date during a briefing in Beijing.

US President Donald Trump defended the tariffs in a tweet on Thursday, but was also optimistic about trade talks with China.

"The United States Treasury has taken in MANY billions of dollars from the Tariffs we are charging China and other countries that have not treated us fairly," Trump tweeted. "In the meantime we are doing well in various Trade Negotiations currently going on. At some point this had to be done!"

Ray Dalio, co-chief investment officer and co-chairman of hedge fund Bridgewater Associates LP, wrote on LinkedIn that "while there will be trade wars and trade truces, they aren't the most important things".

"China has a culture and system that has worked well for it for a long time, so it shouldn't be expected to change much; the US has the same; these systems (and those of other countries) will be both competing and cooperating, and how well they do that will be an important influence on global conditions."

Dalio also said that "there is a lot to respect about the Chinese culture and approach that led to its remarkable accomplishments; we would do well to learn from each other, cooperate and compete to bring each other up rather than to tear each other down, and China is a place we need to continue to evolve with and invest in".

Reuters contributed to this story.

Contact the writer at williamhennelly@chinadailyusa.com