Nation springs a wealth of surprises

Two new billionaires created in China each week

China's billionaires in US dollar terms are making history. Their soaring wealth accumulation has taken the world by surprise, and now wealth management companies globally are launching tailored services to meet their needs.

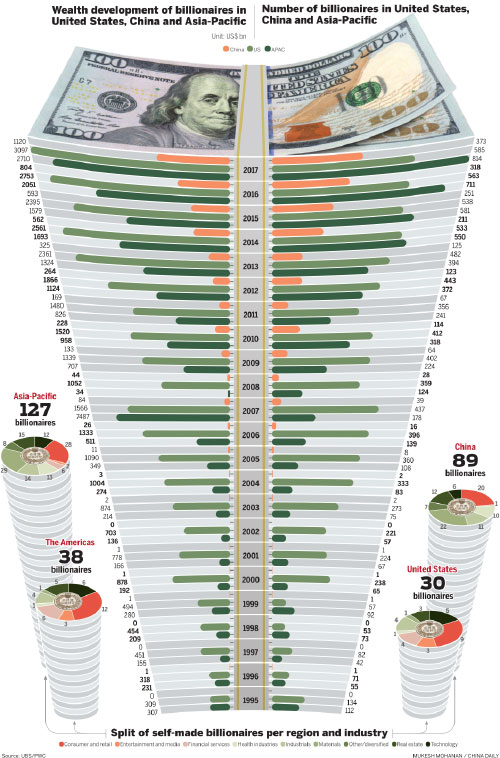

A recent study by UBS and PwC found that two new billionaires a week are being created in China, a faster rate than in any other country.

Fueled by this growth in China, the cumulative wealth of billionaires in the Asia-Pacific region will overtake that of those in the United States for the first time in less than three years, the study forecast.

Josef Stadler, head of ultrahigh net worth at UBS Global Wealth Management, said the acceleration of wealth creation in China has been amazing. "We had been expecting a much slower emergence of wealth creation in the East, but the speed at which China has caught up (with the rest of the world) is surprising," he said.

In 2017, a total of 106 Chinese became billionaires, taking the number in the country to 373, about one-fifth of the global total. The growth was phenomenal considering that there were only 16 Chinese billionaires in 2006.

In comparison, the US still leads the global league table, but wealth creation in that country appears to be slowing, with only 53 new billionaires created in 2017.

Meanwhile, a report published in 2017 by Industrial Bank Co in China and US multinational management consultants the Boston Consulting Group showed the number of high-net-worth families in China is forecast to grow to 3.88 million by the end of next year, from 2.07 million in 2015.

During this period, personal investable assets in China will rise from 113 trillion yuan ($16.8 trillion) to 200 trillion yuan at a compound annual growth rate of 12 percent. Investable assets of high-net-worth individuals will account for 51 percent of the total next year, according to the report.

This clear eastward shift in private wealth has attracted the curiosity of a global audience. For example, the film Crazy Rich Asians, released last year, topped the US box office during its opening weekend, breaking all expectations by taking an estimated $25.23 million in three days.

Booming wealth in China has inspired leading companies such as UBS, Credit Suisse and JPMorgan to expand their Asian operations.

In 2016, UBS announced plans to double its headcount in China by next year. It has achieved this target ahead of time, and is now looking to further expand front-line qualified wealth management advisers.

Seeing the growing need from clients to globally diversify their assets, Bank of China established a private banking department in London last year. Boutique wealth advisers in London, including Cerno Capital and Oracle Capital, have also hired Chinese client advisers and broadened their services to satisfy the needs of wealthy Chinese.

Creating wealth

The wealth accumulation of China's surging numbers of billionaires is deeply rooted in the country's extraordinary economic success in recent decades, and this is now accelerating thanks to the momentum of digital innovation and the huge domestic consumer market.

Marcel Widrig, partner and global private wealth leader at PwC Switzerland, said: "China is currently the leading country for entrepreneurs to create wealth. Nowhere else has the same combination of a huge population, technological innovation and government support."

Many of China's best-known billionaires are entrepreneurs in the innovation sector, including Jack Ma, founder of e-commerce giant Alibaba, Lei Jun, founder of mobile phone maker Xiaomi, and Wang Jian, founder of the genomics sequencing company BGI.

China's digital economy was worth 27.2 trillion yuan in 2017 and accounted for nearly 33 percent of the country's GDP growth, according to the China Academy of Information and Communications Technology. The same year, 171 million people worked in sectors related to the domestic digital economy, accounting for 22 percent of the workforce.

Fast growth and abundant business opportunities in China have contributed to an extremely ambitious and action-oriented mindset among the wealthy, according to one billionaire surveyed by the UBS/PwC report.

"Chinese culture is different to that in the rest of the world, especially the European Union. In China, people work harder and are more willing to experiment by trial and error, while Europeans work in a more structured way. By the time people in the EU have come up with a structured plan, the Chinese have already developed a solution," he said.

China's wealthy have largely made their money at home, but in recent years they have been looking increasingly to diversify their assets globally.

One factor behind this is the country's increasing integration into the global economy, which has led to many Chinese entrepreneurs becoming more aware of overseas investment opportunities.

A considerable number of second-generation wealthy Chinese also have overseas study or work experience, meaning they are more familiar with the concept of global asset distribution as a means to mitigate risks of becoming over-reliant on a particular market.

Some Chinese wealth management companies are helping clients invest in leading overseas funds, such as Blackstone, Carlyle and Sequoia, which then invest in a wide range of global assets including stock options, shares, bonds and other products.

Others have followed their clients overseas, one example being Shanghai's Hywin Capital setting up an operation in the United Kingdom after acquiring the wealth management company Azure Wealth.

The acquisition immediately gave Hywin a mature UK team able to help clients invest, manage asset portfolios and provide tailored help to meet their personal needs such as relocating to the UK, buying property or sending their children to British schools.

Monica Lin, chairwoman of Hywin Capital UK, said, "We recognize that Chinese clients are not just investing in the UK, but are becoming familiar with a very different ecosystem than the one to which they are accustomed.

"For example, they may need to open bank accounts in the UK, obtain UK or European visas, send their children to schools or universities in Europe, acquire property, obtain healthcare, or expand their businesses into the UK or Europe. We are able to provide tailored solutions that meet these needs," Lin said.

Hywin Capital and other boutique advisers, including Cerno Capital and Oracle Capital, are favored by some Chinese clients with a few million dollars to invest in overseas assets. As such, they typically meet the minimum investment requirement at big banks.

Jeny Zhu, head of China investment services at Cerno Capital Partners, said, "Compared with bigger banks, our competitive edge is the significant care and attention we devote to every single client's needs."

Challenges remain

Despite what appear to be immense opportunities, industry insiders believe that most wealth management companies are still struggling to find the best way to gain client trust.

David Chang, CEO of ShouShan Family Wealth Advisors, said, "China's high-net-worth market is like a tempting cake that actually has a hard nut inside, and one only realizes this after taking a bite."

The fact that wealth management as an industry in China only emerged in recent years means there is still an understandable gap between wealthy Chinese and their professional advisers, Chang said.

"For example, although many Chinese agree with the concept of achieving global asset diversification on a conceptual level, they feel reluctant when they realize that investing in overseas assets can typically only generate a 6 to 8 percent return," he said.

Their disappointment is understandable given the fast growth of the Chinese economy in recent decades, meaning many rich Chinese have expectations of higher investment returns. In particular, younger entrepreneurs willing to take risks may take longer to realize the need to allocate some assets to more mature overseas economies.

The greater appetite for risk among wealthy Chinese is also understandable given their age. The UBS/PwC study found that Chinese billionaires are age 56 on average, about a decade younger than their US counterparts.

Guo Feng, the son of a successful entrepreneur and vice-president of a leading financial company, said, "Many entrepreneurs who have created their own wealth are hesitant to hand their money to professional private bankers, because they feel they can do a better job themselves.

"For example, if Jack Ma (the Alibaba founder) or Wang Jianlin (founder of Dalian Wanda Group) set up a wealth management company, I'd be comfortable asking them to look after my money, " Guo said.

"Many of the top global wealth management companies actually grew from successful family businesses, such as JPMorgan's private banking division. I feel that if similar successful family businesses in China move into the wealth management sector, they could more effectively win client trust for the same reason."

- Experts sharpen focus on new frontiers of AI

- Swiss watchmakers celebrate birthday with Shanghai exhibition

- Documents dating to Japan's bacteriological war in China released in Guangzhou

- Former Namibian President: China's contributions will always be bigger than many other countries

- Government program launched to assist China's young job seekers

- Student dorm AC installations fast-tracked in Shandong