Intensified govt policy support set to boost economic growth in Q4

China's credit is expanding again. The country's total social financing increased by over 3 trillion yuan (about $412 billion) in August, the second-highest level recorded in history for the corresponding period. The significant improvement in credit in August was primarily driven by recent policies. Most of the improvement came from an acceleration in government financing, which increased to 1.18 trillion yuan in August from 0.41 trillion yuan in July and 0.30 trillion yuan in August last year.

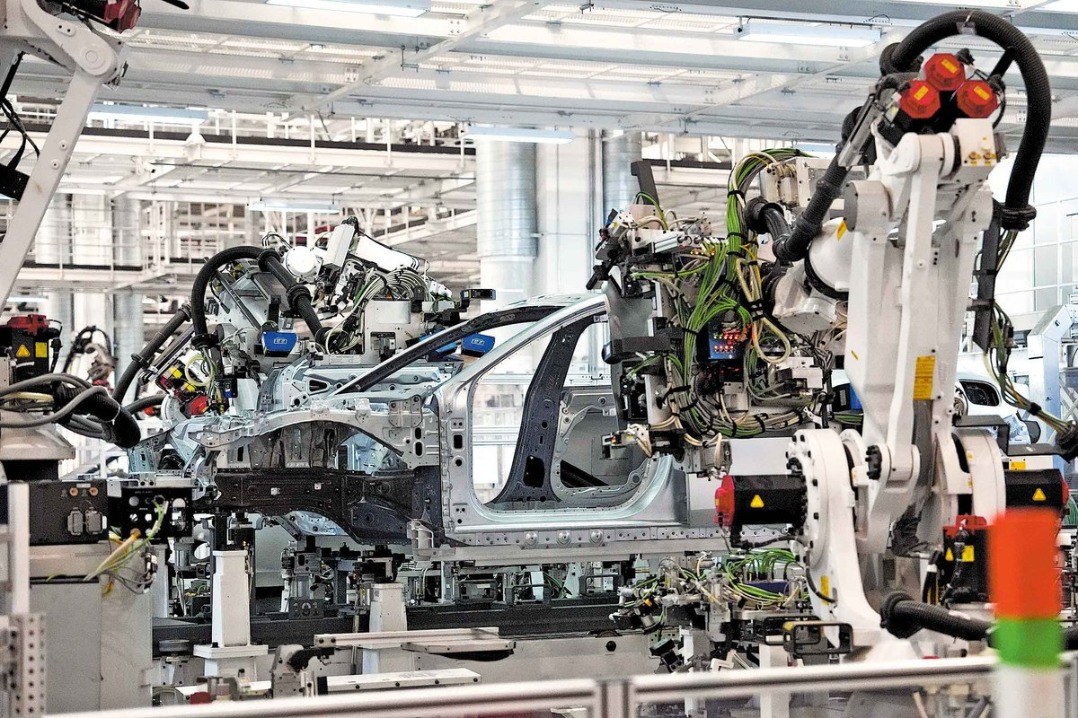

In addition to better credit data, the economic data for the last few weeks have generally shown encouraging signs: the consumer price index turned positive again while the producer price index has shown consistent improvement over the past three months. And while the manufacturing purchasing managers' index improved to 49.7 with key components such as production and new orders being above 50, export and import growth have also improved. Data points so far seem to suggest the economy is stabilizing and starting to recover from its slump in the second quarter and in July.

These positive economic signs emerged after China strengthened its countercyclical macro policy support since mid-August.

China's policy support has gone through two stages after the Political Bureau of the Communist Party of China Central Committee changed its assessment of the economy. During the first stage from late July to early August, the government issued a series of policy guidance papers promoting consumption and investment, the private sector, and welcoming foreign investment. These policies contain important components of the government's new structural reform agenda.

During the second stage, from mid-August till the present, the policy announcements have been different given these are concrete measures with a direct, measurable impact on certain sectors of the economy. Also, the China Securities Regulatory Commission's recent measures — cutting stamp duties and transaction fees, controlling the pace of initial public offerings, encouraging dividends and buybacks while limiting insider sales — are based on earlier consultations with market participants, and the size and breadth of announced measures have exceeded market expectations.

Two types of policy, fiscal policy and property sector policy, are what matter most right now to China's economy.

China's fiscal stance has effectively tightened by almost 2 percent of GDP in the first seven months: year-to-date fiscal deficit was at — 2.5 percent of GDP as of July 2023, compared with-4.3 percent in July 2022, by our calculations. This is mainly because last year's government borrowing and spending was front-loaded in the first half of the year, while this year's borrowing has been more balanced between the first and second half of the year.

Government bond issuance accelerated in August. And increased borrowing should pave the way for the government to introduce more spending measures, including for public investment, in the next few months.

The change in the policy tone of the Political Bureau of the CPC Central Committee vis-a-vis the property sector has paved the way for further policy easing, especially in tier-1 and many tier-2 cities where various purchase and borrowing restrictions still apply. Tier-1 and tier-2 cities account for more than half of housing sales nationwide; as such, policy changes in these cities will have significant implications on the housing market.

On Aug 31, the People's Bank of China, the country's central bank, and the National Administration of Financial Regulation jointly issued a series of easing measures for the property sector, which includes lowering minimum down payment ratio and mortgage interest rate, easing criteria for first-home buyers and interest rate cuts for existing first-home mortgage loans.

The interest rate cut on existing mortgage loans could boost consumption to a certain extent. A 100 basis point interest rate cut on the 38 trillion yuan of outstanding mortgage loans could save Chinese consumers 0.4 trillion yuan a year, equivalent to roughly 1 percent of annual retail sales. The near-term impact might be greater because many borrowers increased mortgage loan repayment this year owing to high interest rates. But the rate cut will also reduce the incentives for early repayment.

Based on our forecast, the third quarter of this year should be the low point of growth in the year at 4.6 percent, while the fourth quarter growth should improve to 5 percent thanks to intensified government policy support since mid-August, especially that targeting the property sector.

The author is chief China economist at Deutsche Bank.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.