Signs of consolidated recovery

Editor's note: China's economy is shifting to high-quality development amid structural adjustments and external uncertainties. While growth has faced challenges from weak consumption, exports, and the property market, recent policy measures are starting to show positive effects. Two economists share their insights on China's economic outlook for the fourth quarter with China Daily. Excerpts follow:

Strong start to Q4

We estimate China's growth increased by 0.4 percentage point to 5.3 percent year-on-year in October, based on China's official monthly data release. It was largely driven by an improvement in domestic demand on the back of recent policy stimulus measures. Retail sales growth rebounded to 4.8 percent year-on-year, up 1.6 percentage points, thanks to a surge in home appliances, furniture and car sales with help from the government's cash subsidies. Service sector growth also improved to 6.3 percent year-on-year, up 1.1 percentage points; property sales have recovered despite further price drops, and financial services activity has been boosted by monetary and capital market easing measures. Meanwhile, industrial production and fixed asset investment growth were both flat from last month, suggesting the government is prioritizing domestic consumer demand, an approach different from in the past.

Our expectation is for 5 percent growth in the fourth quarter and 4.9 percent annually in 2024, and we see upside risks if the upward momentum is sustained through year-end. Although the government's recent fiscal announcement fell short of market expectations, we think it has sufficient room to keep fiscal spending expansionary through the fourth quarter. Meanwhile, it has room for further property policy, including cutting property transaction taxes and expanding the scope of urban renewal projects to 300 cities, to sustain the property sector recovery.

October's economic activity showed further improvement, particularly in retail sales, services, and housing, boosted by recently implemented stimulus measures.

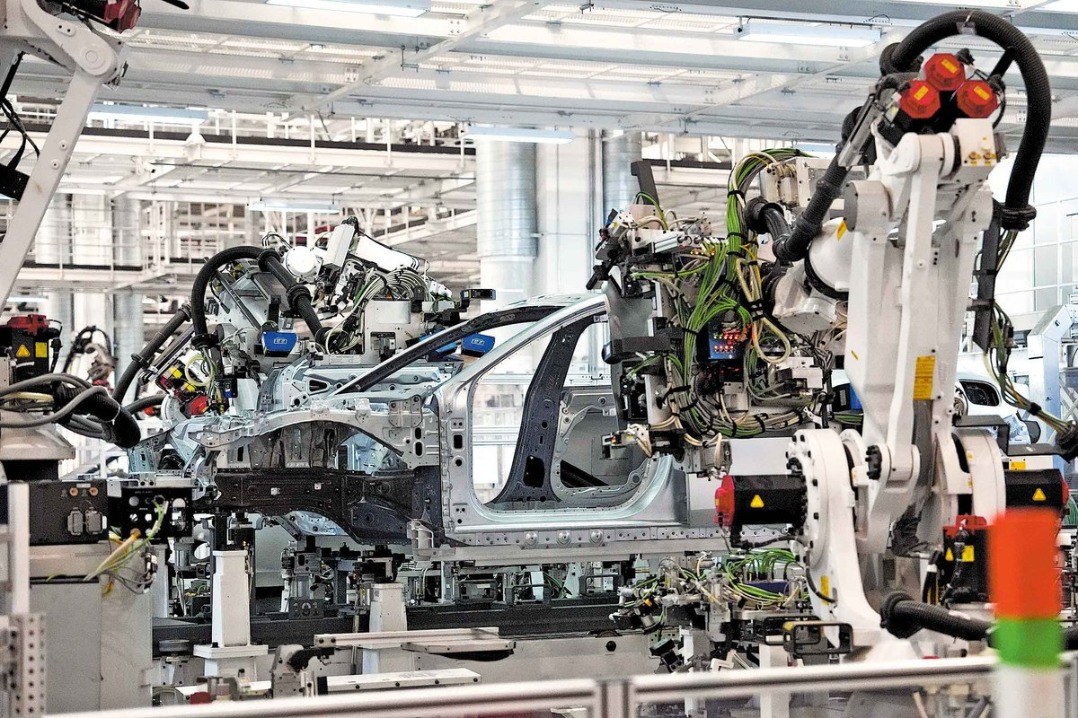

Industrial production decelerated slightly by 0.1 percentage point to 5.3 percent year-on-year. Production slowed in mid-stream industries, such as machinery and metal manufacturing, where growth fell by 1-2 percentage points year-on-year. In contrast, auto manufacturing output improved by 1.6 percentage points, likely fueled by the trade-in program. Export delivery values rebounded slightly by 0.3 percentage point to 3.7 percent year-on-year, as exports activities recovered from typhoon disruptions.

Services output improved by 1.2 percentage points to 6.3 percent year-on-year, marking the highest level this year. The largest improvement was the financial services industry, whose output increased by 3.7 percentage points to 10.2 percent year-on-year thanks to the central bank's monetary easing and increased capital market activity since late September. Services related to the property market also seem to have rebounded considerably, thanks to improved market sentiment and sales.

Retail sales rose by 1.6 percentage points to 4.8 percent year-on-year, primarily driven by the front-loaded online sales events and further utilization of the consumer goods trade-in program. Major online platforms started sales/pre-sales 8-13 days earlier than last year for this year's Double 11 online sales event, and the contribution of online sales to overall retail sales growth rose by 3.3 percentage points. Non-online sales also improved and contributed 1.5 percentage points to overall sales. Sales of home appliances, sports and recreational goods, cultural and office supplies, and communication devices all recorded high double-digit year-on-year growth: 39 percent, 27 percent, 18 percent and 14 percent, respectively. Automobile sales also improved by 3.3 percentage points to 3.7 percent year-on-year.

Fixed asset investment held steady at 3.4 percent year-on-year. Infrastructure investment improved by 3.6 percentage points to 5.8 percent year-on-year, the highest level since April. Manufacturing investment also saw a mild improvement of 0.3 percentage point to 10 percent year-on-year.