Goldwind calls off HK IPO

Updated: 2010-06-15 06:41

By Li Tao(HK Edition)

|

|||||||||

|

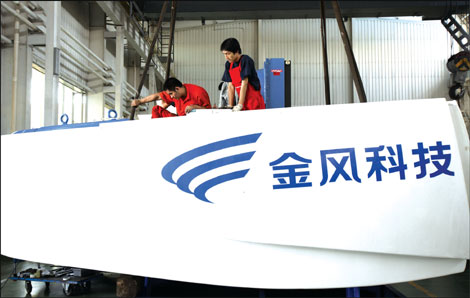

Workers assemble a wind turbine at Goldwind Science & Technology Co, Ltd in Urumuqi, Xinjiang Uygur Autonomous Region in Northwestern China. The company announced Monday it has called off its planned IPO in Hong Kong. Qilai Shen / Bloomberg News |

Deterioration in market conditions cited as a reason

Xinjiang Goldwind Science & Technology Co, China's No 2 and the world's fifth largest wind-turbine manufacturer, has called off its initial public offering (IPO) in Hong Kong - in another sign that indicates a further cooling in the IPO market.

Goldwind's is the fourth Hong Kong IPO to have been shelved since last month.

"In light of the deterioration in market conditions and recent unexpected and excessive market volatility, the company formed the view that it would be inadvisable to proceed with the global offering at this time," the company said in a statement filed with the Hong Kong stock exchange Monday.

The Shenzhen-listed company was planning to raise as much as HK$9.09 billion in a share sale in Hong Kong. Reports last Friday said it has decided to lower the low end of its indicative price range by about 9 percent as buy orders from public investors failed to reach the "target".

"The lackluster market is easy to tell from the low daily trade volume (of the market)," said Castor Pang, research director at Cinda International. "The average daily turnover of around HK$30 billion so far this month was only half of that in May, which indicated fear among investors who feel uncertain about the European economy as well as the Shanghai stock market."

Goldwind's fallout follows Swire Properties Ltd, Strikeforce Mining & Resources Plc and China Tian Yuan Mining Ltd, which all announced delays of their Hong Kong listings in May.

Separately, Asian Capital Holding Ltd, a corporate advisory group that had planned to list on the growth enterprise market in Hong Kong, announced Monday that it will sell 300 million shares through a private share placement to selected investors and certain employees only, rather than through a public offering.

"We chose to sell shares through a share placement instead of a public offering largely due to fear of the market's volatility," Executive Chairman Patrick Yeung of Asian Capital said in a statement.

Reports, without citing sources, in the same day indicated that many investors decided to skip the Goldwind sale in expectation of the upcoming mega-IPO of Agricultural Bank of China Ltd in Shanghai and Hong Kong.

According to a term sheet released Monday, the bank is seeking to raise up to $14.4 billion in the Hong Kong portion of the offering, of which 95 percent will be placement shares for institution investors with the remaining 5 percent allocated to retail investors.

Excluding the over-allotment, the total $23.1 billion expected from the sale in the two markets would make it the largest IPO in history.

"It's hard to say if Agricultural Bank of China's dual listings will be welcomed or not in such a lukewarm market," said Cinda's Pang. "If the bank commands a valuation of 1.5 times its book value, the market is more likely to respond positively. It will be hard (for the bank to attract investors) if the stock is priced higher," Pang added.

China Daily

(HK Edition 06/15/2010 page3)