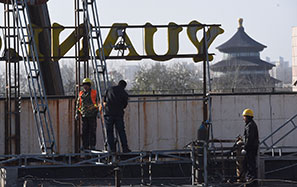

Markets set to rise, predicts CICC chairman

BEIJING - China's stock market is approaching its bottom, as the recent slump was triggered by the turmoil in the global capital market rather than a domestic slowdown.

That's the view of the chairman of the country's leading investment bank, China International Capital Corporation (CICC).

"I personally predict that the price of A shares is close to a bottom now after several weeks of declines," Li Jiange, said in an exclusive interview with China Daily.

He added: "The possibility of a double-dip global economic recession remains low."

The main Shanghai Composite Index (SCI) fell slightly on Friday, trimming the first weekly gain in six weeks after losing 2.27 percent the week before.

Despite the weekly rise, however, the SCI remains at a low level. It is valued at 12 times estimated earnings, compared with a record low of 11.57 times set on Aug 22, according to data compiled by Bloomberg. It has lost 7 percent this year as the central bank raised interest rates five times and required lenders to set aside more cash as deposit reserves 12 times since the start of 2010 to curb rising inflation.

Plagued by the sluggish capital market, CICC's net profit slid nearly 70 percent to 130 million yuan ($20.35 million) in the first half of the year, while revenue declined 26.66 percent year-on-year to 1.41 billion yuan, according to the company's interim statement released in July. Other major investment banks also suffered losses due to the market slump.

"Since there are so many uncertainties in the market, our business performance for the rest of the year is hard to forecast," said Li.

That would partly explain why CICC doesn't want to rush into overseas expansion.

Li said that China is the "beacon" of the world economy in terms of its economic performance, and the domestic market should remain the focus and priority of the company's business.

However, he also said that Central Asia and Russia were among the potential areas for expansion, especially as Russia is undergoing a wave of "privatization" where companies are seeking to be listed on stock markets, which is providing greater opportunities.

Meanwhile, there might also be attractive merger and acquisitions opportunities (M&A) for CICC, Li added.

Currently, CICC has a presence in Hong Kong, Singapore, New York and London. And the company has been striving to serve Chinese companies seeking overseas listing and M&A opportunities.

Accompanying the company's "go global" strategy, CICC has been working to diversify its business lines to hedge the risks from the capital market. Currently, the company's investment banking business accounts for about 50 percent of overall business revenue, compared with 80 percent in its early years.

Earlier this month, the company expanding its business into the trust industry by taking a 35 percent stake in Hangzhou-based Zheshang Jinhui Trust Co.

In June, CICC became the first Chinese member of the London Stock Exchange. Since then it has been allowed to trade UK stocks, international deposits, funds and commodities.

The same month saw CICC launch a yuan-denominated private equity fund with the approval of the China Securities Regulatory Commission, the country's securities regulator. The CICC Industrial Integration Fund was set to raise 5 billion yuan with a focus on M&A and investment.

"The fund has had several investments so far, with some of the target projects being pretty attractive," said Li.

Although CITIC Securities Co Ltd, one of CICC's main rivals, recently began its plan to list in Hong Kong, Li said an IPO is still a long-term strategy for CICC.

"On the one hand, our new strategic investors still need some time to understand the company; on the other, some of our business lines are not strong at the moment and their investment value needs time to mature," said Li.

In December, the industry regulator gave approval for Morgan Stanley to transfer its 34.3 percent stake in CICC to Kohlberg Kravis Roberts & Co, TPG Capital, the Government of Singapore Investment Corporation Pte Ltd and Great Eastern Life Assurance Company Limited.

This move, some analysts said, may accelerate CICC's listing process.