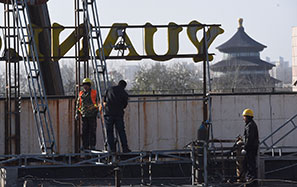

RMB bill threatens trade war

During the debt-ceiling debacle, Washington pushed the United States economy close to an abyss. Now it is risking US-China relations.

Two months ago, Chinese officials were appalled by the US debt impasse. A month ago, Vice-President Joe Biden, after Washington's summer-long debt drama, sought to assure Beijing that "a successful China can make our country more prosperous, not less".

Now the Senate is weighing "whether to punish China for undervaluing its currency and taking away American jobs".

The proposed Currency Exchange Rate Oversight Reform Act of 2011 would allow the US government to slap countervailing duties on products from countries found to be subsidizing their exports by undervaluing their currencies. It will achieve nothing to ease US unemployment. It is straining US-China relations at the worst possible moment, and it will risk a trade war at a time when Washington can least afford one.

Despite bipartisan backing, the legislation would face overwhelming hurdles before it becomes law. After all, Barack Obama's White House, while believing Chinese renminbi to be undervalued, is wary of unilateral sanctions against China. This concern is widely shared by leading US business groups, and even House GOP leaders show little interest in bringing the bill to a vote.

If, however, the bill has no effective bipartisan support and it is rejected by US business, why does it have bipartisan backing?

The short answer is that political positioning for the 2012 presidential election is already trumping economic rationality. The topical answer is that, in political positioning, timing matters. It is hardly a coincidence that the Senate took up the bill on the very same day that the White House sent to Congress free trade agreements (FTAs) with South Korea, Colombia and Panama.

For months, a number of congressional Democrats have seen the FTAs as threats to US jobs. With lingering unemployment, anti-incumbency mood and political volatility, the renminbi serves as a convenient distraction. By supporting an ineffective currency bill, they have an opportunity to talk and appear tough on perceived unfair trade practices.

"China emerges as a scapegoat in campaign ads," The New York Times reported on last year's mid-term elections in October. In the second act, the renminbi serves as a smoke screen for three FTAs that Congress feels uneasy with.

In the past, surging food, fuel and other commodity prices in China have put greater pressure on China to allow a faster rise in the value of the renminbi to contain inflation. At the same time, China's central bank has continued its drive to appreciate the yuan to fight imported inflation.

Even the current pace of appreciation means that China's trade surplus could diminish within half a decade, as inflation is likely to continue to push up the renminbi in real effective exchange rate terms.

Ultimately, the currency issue is not bilateral and only between the US and China. It is multilateral and regional.

Think about it. Two to three decades ago, when you purchased a TV in the US, the label typically read "Made in Japan". More recently, that label probably said "Made in Korea". Today it says "Made in China". During the past decade, the role of China in the US trade deficit has climbed from 19 percent to 43 percent, so some observers have concluded that China is responsible for the deficit.

In reality, many of the goods the US used to import came first from Japan, then from the East Asian tiger economies, just as today they come from China. As many leading Asian companies have moved export manufacturing bases to China, "China's share" of the US trade deficit has risen in relative terms in trade data, but not in money flows.

For instance, Apple has outsourced its production to Foxconn, whose production engines are in China. However, it hardly follows that China is engaged in unfair trade against the US. Rather, China's current share of the US trade deficit reflects East Asia's central role as the world factory.

In a global economy with deficient aggregate demand, current-account surpluses are a problem. But there are no simple solutions.

After all, China has a bilateral and multilateral surplus, but so does Saudi Arabia. In absolute value, Saudi Arabia's multilateral merchandise surplus of $150 billion last year is less than half of China's $254 billion surplus. As a percentage of GDP, however, Saudi Arabia's current-account surplus, at 15.8 percent of GDP, is more than threefold that of China.

In fact, China's current-account surplus is actually less than Germany's. As a percentage of GDP, it is 5.2 percent, compared to Germany's 5.7 percent.

It would be a mistake to blame German exports for US unemployment, or Saudi Riyal for the US' need for oil. Conversely, Washington hardly wants to hear Europeans accuse the US for reckless budget deficits, or Brazil blame the US for low interest rates that can lead to a weak currency, or the BRICS preach about the threats of imported inflation from the West.

In reality, many factors other than exchange rates affect a country's trade balance, including national savings. The US' multilateral trade deficit will not be significantly narrowed until the country saves significantly more.

Rebalancing is a two-way street. What G20 nations need today is more cooperation, not confrontation like in the 1930s.

The author is research director of international business at the India, China and America Institute, an independent think tank based in the US, and a visiting fellow at the Shanghai Institutes for International Studies.

(China Daily 10/11/2011 page9)