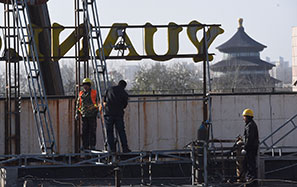

Parsons out, O'Neill in at Citigroup Inc

NEW YORK - Citigroup Inc Chairman Richard Parsons, who helped the bank become a behemoth that almost collapsed in the financial crisis and then led its recovery, will be replaced by fellow director Michael O'Neill.

O'Neill will take over after the firm's shareholder meeting in April, New York-based Citigroup said in a statement. Parsons, 63, spent 16 years on the board, becoming chairman in 2009 after the bank's $45 billion bailout by United States' taxpayers.

Parsons' successor inherits a board grappling with a slump in revenue, higher costs and new regulations as Chief Executive Officer Vikram Pandit pushes the firm into emerging markets. Citigroup has repaid the US Treasury Department's rescue, which generated a profit of about $12 billion for taxpayers. The firm posted total net income of $21.9 billion for 2010 and 2011, compared with $29.3 billion of losses for 2008 and 2009.

"Parsons can walk out knowing he was part of the problem but he was also part of the solution," said David Knutson, a credit analyst in Chicago with Legal & General Investment Management, which owns Citigroup debt. "He, along with his management team, managed to steer Citi through probably the toughest crisis of the last two decades."

Board members Alain Belda and Timothy Collins also will leave the panel, Citigroup said.

Parsons, who grew up in Brooklyn's Bedford-Stuyvesant neighborhood, joined President Barack Obama's advisory panel on jobs in February 2011. He is a senior adviser to Rhode Island-based Providence Equity Partners Inc, which specializes in buying media and telecommunications businesses.

"Given the strong position that Citi is in today, I have concluded that the time has come for me to take my leave," Parsons said in the statement. "I have complete confidence in the management team, the actions they have taken to strengthen Citi and the course they have charted for the future."

Citigroup has climbed 30 percent this year, the third-best performance in the 24-company KBW Bank Index. The shares are down 76 percent since the end of 1996, the year when Parsons became a director. The bank suspended dividends after he was named chairman in 2009 and approved a 1 cent quarterly payout last year.

Parsons, in an interview last year with Bloomberg Businessweek, said his relationships with then-Comptroller of the Currency John Dugan and Treasury Secretary Timothy F. Geithner helped Citigroup weather the financial crisis.

"Timmy Geithner would say, 'Call me directly, because this is too important an institution to go down'," Parsons said.

Parsons led Dime Savings Bank of New York before joining Citigroup's board in 1996. He became a Time Warner Inc executive about the same time and supported the firm's 2001 takeover by America Online Inc. He served as CEO and chairman of the combined company after it took a record $54 billion writedown tied to the deal.

At Citigroup, he was among directors who oversaw the transition of the firm into the biggest bank in the world under CEOs Sanford "Sandy" Weill and Charles "Chuck" Prince. During Parsons' tenure on the board, the lender invested in bonds tied to subprime mortgages, which later caused losses as the loans soured and almost forced the firm's collapse.

The directors failed to ensure that Citigroup had "effective" risk management, according to a Feb 14, 2008, letter to Pandit from John Lyons, an Office of the Comptroller of the Currency examiner. Managers were more concerned with short-term performance than potential losses, Lyons wrote.

Parsons replaced Win Bischoff as chairman on Feb 23, 2009, at the request of fellow board members, shortly after the government provided the bailout and guaranteed $301 billion in risky assets. He tapped new directors to bolster the board's banking experience, including O'Neill, Jerry Grundhofer, Anthony Santomero, Robert Joss and William Thompson.

Not everyone supported Parsons in the wake of the bailout. Glass Lewis & Co, a shareholder advisory firm, recommended last year that investors vote him off the board and that they should "still be concerned with the poor oversight" provided by Parsons and other directors.

"His exit was probably a bit more graceful than some of the others," said Knutson, referring to former senior figures at other Wall Street banks.

Bloomberg News