Credit crunch seen creating openings for PE, VC firms

China's credit crunch may create opportunities for private equity firms, while fundraising activities will see some challenges, according to PE industry insiders.

China's central bank has indicated that its credit-tightening policy will continue, reflecting the top policymakers' increasing tolerance for slower growth.

Frankie Fang, LGT Capital Partners' China representative, told China Daily that in the near term a lot of companies will be revalued due to China's slowing economy and reduced access to bank loans.

"PE investors will have more buying opportunities in China and stronger bargaining power," said Fang.

LGT Capital Partners is a major private banking and asset management group in Europe and a limited partner of PE firms.

However, Fang added that the overall fundraising activities of Chinese PE and venture capital firms will be influenced by the weaker macroeconomic conditions.

ChinaVenture Group released a report in April indicating that the fundraising activities of PE firms with businesses in China was not favorable, with 42 percent of them saying that they were considering financing for their funds and 39 percent raising funds. Only 10 percent of PE firms accomplished financing for their new funds in the previous year, the report said.

Wang Chaoyong, chairman and chief executive officer of ChinaEquity Group, told China Daily that PE investments have a lower risk and are more popular than investments in trust and financial products when the liquidity conditions are not good.

"I believe that China's credit crunch is positive for the PE sector, but banks will be able to solve their problems," said Wang, explaining that banks can revitalize their stock capital when their core capital is tighter.

According to Wang, exit strategies are still the key issue for PE investors.

A recent ChinaVenture report said that the exit conditions for PE and VC firms in China became harder after initial public offerings at home and abroad stagnated. The report added that there have been about 9,000 PE investment deals not cashed out since 2002.

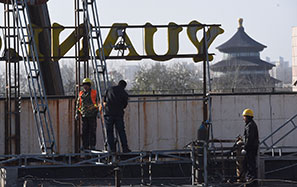

For the Carlyle Group, the expected de-leveraging of the Chinese market looks similar to the global financial crisis five years ago.

Carlyle put a lot of money to work into the ground during the last several years in very good investments because they were able to acquire assets at good prices under the circumstances, according to Randy Quarles, Carlyle's managing director.