Currency reserve to assist liquidity

China biggest contributor to fund that will aid developing economies

China will contribute the lion's share to a foreign currency reserve set up by major emerging economies to mitigate liquidity strains as the US pulls back from its monetary stimulus.

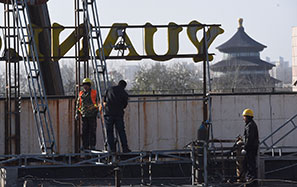

Leaders of Brazil, Russia, India, China and South Africa, better known as BRICS, agreed on Thursday to create a $100 billion pool of currency reserves as they met on the sidelines of the G20 summit in St. Petersburg, Russia.

Analysts said the reserve fund will help ease short-term liquidity pressure and safeguard the financial stability of major emerging economies.

China will contribute $41 billion, and Brazil, India and Russia will each invest $18 billion, with South Africa paying the remaining $5 billion.

"Consensus has been achieved on many key aspects and operational details" regarding the establishment of the fund, said a statement issued after the meeting.

Zhang Monan, an economist at the State Information Center under the National Development and Reform Commission, said a mutual reserve will be a "financial firewall" for BRICS countries.

"The US tapering off its quantitative easing later this year will have a profound impact on the global financial market, especially emerging economies," Zhang said, explaining that such an impact will involve capital outflow and depreciation of domestic currency and assets.

The US Federal Reserve is widely expected to take its first steps this month to reduce the extraordinary monetary stimulus, which observers said will bring turmoil and substantial spillover effects to a global financial system where the US dollar accounts for 62 percent of reserve assets.

South Africa's rand has depreciated 17.7 percent against the dollar this year, the most among 24 emerging-market currencies tracked by Bloomberg. India's rupee was second worst, depreciating 16.9 percent, while the Chinese currency has strengthened 1.8 percent.

"We see the temporary difficulties of some BRICS countries mainly as difficulties in terms of international balance of payments," Vice-Minister of Finance Zhu Guangyao said on Thursday.

"The policy options in response to such difficulties include increasing interest rates or devaluing currencies."

"We hope the US will carefully consider its decision to exit its quantitative easing policy to make more contribution to the global economy," he said.

Zhang suggested that BRICS countries should enhance financial ties by boosting investment exchanges, expanding currency swaps, encouraging trade settlement in local currencies and promoting convertibility among their currencies to prevent capital outflows.

The emerging economies are mostly net creditors to developed nations, as they accounted for 75 percent of the world's total currency reserves, among which China contributed one-third of the world's total.

"The gravity of the global economy has moved from the West to the East, but the power of wealth distribution is still in the hands of Western countries," Zhang said.

Yang Baorong, a researcher of West Asian and African studies at the Chinese Academy of Social Sciences, said setting up mutual currency reserves is vital to challenging the global financial order dominated by developed economies.

The fund can help guarantee the safety of internal trade among these countries and significantly lower trade costs.

However, Yang said, the reserve is just a framework at the moment, and there will be uncertainty and adjustment to go through when it is put into practice.

Chinese officials defended the resilience of emerging economies.

Qin Gang, spokesman for the Chinese delegation at the G20, denied the pessimistic views on the prospects of emerging economies, saying that BRICS countries will continue to make their contribution to the world's economy.

Vice-Minister of Finance Zhu said China is confident of achieving its goal of 7.5 percent growth this year, which will contribute 28 percent of global GDP growth, compared with about 12 percent by the US.

But, Zhu said, BRICS countries have reached a consensus that they will not consider extra stimulus to combat the temporary economic slowdown.

Progress was also made on Thursday on the BRICS-led New Development Bank in negotiating its capital structure, membership, shareholding and governance. The bank will have an initial subscribed capital of $50 billion from the BRICS countries.

The money will mainly finance infrastructure projects, and other developing economies may also benefit from the initiative, Zhu said.

Reuters contributed to this story.

|

President Xi Jinping and his Russian counterpart Vladimir Putin have a talk before they attend a meeting of G20 leaders in St. Petersburg, Russia, on Thursday. Photo by Agence France-Presse |