SOE reforms to be launched after plenum

Private capital will have easier access to invest in State firms

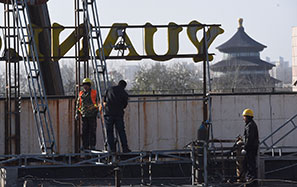

Major steps to reform State-owned enterprises will be taken after the four-day Third Plenum of the Communist Party of China's 18th Central Committee, which started on Saturday, said Huang Shuhe, vice-chairman of the State-owned Assets Supervision and Administration Commission.

To pave the way for changes, commission officials said private companies and investors are welcome to acquire larger shares in SOEs so they can have a bigger say in decision-making.

There are 112 large State-owned corporations under the direct supervision of the commission.

"Private investors can set up private equities to take over 10 to 15 percent of an SOE's equity," said Bai Yingzi, director of the commission's enterprise reform division.

The restructuring and upgrading of State-owned enterprises is at a crucial stage, and Huang said further ownership diversification is "a high priority" that will benefit sustainable development of the Chinese economy.

Specific plans on SOE reforms are expected to be drafted after the third plenum.

Bai admitted that while SOEs may be too big for most privately held enterprises to invest in, private companies can band together to buy into them or take on specific projects.

The total assets of central SOEs were worth 44.8 trillion yuan ($7.35 trillion) at the end of 2012.

In early 2013, China National Petroleum Corp, the largest SOE, owned assets worth about 2.2 trillion yuan. In comparison, China's largest private industrial conglomerate Fosun Group had total assets worth only 150 billion yuan.

Despite the gap in assets, SOEs and private companies will have serious problems if they don't have diversified ownership, said Song Zhiping, president of China National Building Material Corp.

As the top manager of a Fortune Global 500 company, Song suggests that after purchasing another company, the building materials company should leave 30 percent of the equity to private investors.

At present, the company operates net assets of 60 billion yuan, of which 20 billion yuan are owned by the State-owned Assets Supervision and Administration Commission and 40 billion by small shareholders.

According to the commission, private investment in SOEs is carried out mostly through deals with SOE subsidiaries or State-owned enterprises at the provincial level.

However, in a rare exception, Fosun established a joint venture with China National Medicine Corp in 2003 with registered capital of 1.027 billion yuan, the biggest deal yet between private and State-owned companies.

With its 500 million yuan investment, Fosun owns 49 percent of the venture, and the State-run CNM owns 51 percent.

Bai said that this is a pilot deal for injecting private capital into State-owned assets.

Diversified ownership is the direction for SOE reform. "All kinds of companies could join SOE restructuring," said Bai.

During the World Economic Forum in September, Premier Li Keqiang said that the government will ease market access to financial institutions of various ownerships to develop their business, including both private and foreign companies.

China's five biggest banks accounted for 35 percent of the profits by the country's 500 biggest companies last year, data from the Chinese Enterprise Confederation show.

Singaporean investment company Temasek Holdings has been optimistic about China's banking sector.

Its investment in China Construction Bank accounted for 8 percent of the Singapore State investor's portfolio. Temasek holds stakes of almost $18 billion in China Construction Bank, Industrial and Commercial Bank of China and Bank of China, making it the biggest foreign investor in Chinese banks.

Privately held companies are showing increasing interest in tapping into the financial sector.

Retail giant Suning Commerce Group and Gree Electric Appliances were reported to have applied for banking licenses in September, just one month after the State Council said it would launch pilot programs for banks by private investors.

baochang@chinadaily.com.cn