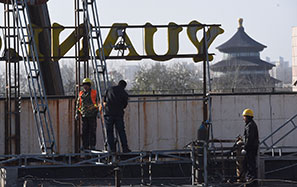

Largest IPO of Chinese Web firm yet

JD.com, China's second-biggest electronic commerce company, filed to raise $1.5 billion in a US initial public offering that would be the largest by a Chinese Internet company, reflecting China's booming online retail market.

"Investors are very hungry for the piece of consumer e-commerce space in China," Francis Gaskins, a partner at IPO research company IPODesktop.com, was quoted by Reuters. US investors regained their appetite for Chinese stocks late in 2013 after accounting scandals froze demand. The number of US-listed Chinese stocks peaked at 40 in 2010.

Baidu Inc, China's largest search-engine company, raised $122 million in a 2005 New York IPO.

Formerly known as 360buy Jingdong Inc and backed by Saudi billionaire Prince Alwaleed bin Talal, JD.com is said to be trying to hold its IPO in the US ahead of rival and market leader Alibaba Group Holding Ltd. Alibaba has not yet announced plans for a US IPO. If it were to go public this year as expected, the offering would be the biggest since Facebook Inc's 2012 deal.

China is on a course to overtake the US as the world's biggest online retail market this year with predicted sales of nearly $180 billion, as increasingly wealthy middle-class shoppers buy more items online and improvements to the nation's distribution network kick in.

JD.com, founded in 1998 as Jingdong Century Trading Co, is reaping the benefits of the boom. It said in December it would top its 2013 sales target of 100 billion yuan ($16.5 billion).

The Beijing-based company and other web-based retailers in China, including US global retailing giants Wal-Mart and Amazon Inc, dwell in Alibaba's shadow, which has captured nearly 80 percent of the Chinese market. Bankers predict an Alibaba IPO could raise up to $15 billion and value the company at more than $100 billion.

JD.com tries to differentiate itself from Alibaba by operating its own network of couriers and warehouses, a factor it says ensures timely and efficient delivery. Alibaba depends on merchants and external courier firms for their logistics.

With 35.8 million active customer accounts, JD.com posted a profit for the first nine months of 2013 after a string of losses, according to the IPO filing. It had 35.8 million active customer accounts and processed 211.7 million orders in the first nine months of 2013. Revenue surged 70 percent to $8 billion in the period.

Founder and CEO Richard Liu owns a 46 percent interest in JD.com, according to the filing. Alwaleed's Kingdom Holding Co owns about 5 percent while Tiger Global Management LLC has 22 percent.

JD.com's IPO filing did not reveal how many American depositary shares it planned to sell, the expected share price or the exchange on which the shares would trade. It said the $1.5 billion figure is a placeholder used to calculate fees and may change. The company said it would use the offering proceeds to buy more land rights, build new warehouses, expand its distribution and make acquisitions.

The filing cited last week's ruling by a Securities and Exchange Commission administrative law judge that four Chinese units of the "Big Four" auditing firms should face a six-month suspension from auditing US-traded companies as a risk factor. Saying its independent registered public accounting firm is one of the four firms subject to the suspension, JD.com's filing said the company could be "adversely affected by the outcome of the proceedings, along with other US-listed companies audited by these accounting firms".

The firms receiving the bans have said they will appeal the decision. In his judgment, Administrative Law Judge Cameron Elliot said the firms broke US law when they refused to turn over certain client documents for inspection to aid in SEC investigations of possible fraud. The Chinese firms insisted their hands were tied by Chinese law which treats the audit documents as "state secrets".

China's securities subsequently accused the SEC of ignoring China's efforts and progress made on cross-border rules cooperation. Deloitte Touche Tohmatsu CPA Ltd, PricewaterhouseCoopers Zhong Tian CPAs Ltd, Ernst & Young Hua Ming LLP and KPMG Huazhen have 21 days to file a petition for review with the SEC before the Jan 22 ruling would become final.

The ruling interrupted what appeared to be a rally in Chinese IPOs in the US after the accounting scandals dried up offerings from that group. 2013 saw eight initial public offerings, representing an increase from the three Chinese listings held in 2012.

michaelbarris@chinadailyusa.com