Equities get lift from reserve cut, IPO approvals

Stocks posted their largest gain in a month on Tuesday on news that initial public offerings would resume and some banks' reserve requirements would fall.

Analysts said the green light for a new round of IPOs lifted some of the uncertainties that had been weighing on the market and indicated that investors are eager to put their money to work.

"Theoretically, the resumption of IPOs will divert capital from the secondary market. However, that concern has been fully priced in. The announcement on Monday actually ended the negative message in this regard and helped stabilize the stock market," said Yang Delong, chief analyst of Shenzhen-based China Southern Asset Management Co Ltd.

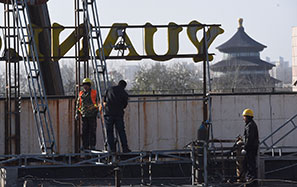

The China Securities Regulatory Commission said on Monday that it had given final approval to 10 companies seeking to list on the Shanghai or Shenzhen stock exchanges.

Seven of the 10 said in their prospectuses on Tuesday that they would start to take subscriptions as early as next Wednesday.

New offerings resumed in January after a 14-month suspension, during which time the CSRC reformed the listing rules. But IPOs were again quickly suspended after critics said that the new regulations weren't halting aggressive cash-outs and insider trading.

The seven companies include Guangdong Ellington Electronics Technology Co Ltd, Shanghai Beite Technology Co Ltd and Shanghai Lianming Machinery Co Ltd. They aim to raise a total of about 16 billion yuan ($2.57 billion), according to their prospectuses. Three will list in Shanghai and four on the smaller Shenzhen exchange.

Guangdong Ellington will be the biggest listing. The company plans to issue 120 million shares to raise 1.31 billion yuan.

Analysts said that based on the terms outlined in the prospectuses, the price-earnings ratios for these new IPO candidates would be mostly below those of listed peers, indicating new offerings at this round might adopt relatively low valuations.

The benchmark Shanghai Composite Index rose 1.08 percent to 2,052.53 points, with turnover rising to 65.4 billion yuan from 55.1 billion yuan on Monday. Information technology, electronics and financial companies led the rally.

However, some analysts cautioned that the rebound in the stock market isn't sustainable.

"The market has gone through downward corrections earlier and recently got a moderate boost from some positive news, such as the targeted reserve ratio cuts. But the foundation of an overall economic recovery is not so solid, given that the HSBC Holdings Plc final Purchasing Managers Index reading was lower than the flash reading in May and that imports declined in the month," said a report by Shenyin Wanguo Securities Co Ltd on Tuesday.

The People's Bank of China, the central bank, on Monday announced targeted cuts in banks' reserve requirement ratios, a move intended to support small companies and agriculture.

"It is not a large-scale [reserve cut], so the impact on the real economy will be limited. But it is a signal of the monetary stance, so it will be positive in supporting the stock index in the short term. The rebound won't be too strong, considering the macroeconomic situation at this stage," Yang said.

A report from Bank of America Merrill Lynch on Tuesday said the expansion of the targeted ratio cuts may raise hopes of an upcoming cut across the board, but the chance of such an aggressive move "could be quite small in the near term".

Premier Li Keqiang is determined to break away from the past mode of policy easing by rolling out "targeted stimulus measures" that emphasize fiscal spending by the central government, reducing funding costs, especially for small borrowers, attracting private capital and easing outdated restrictions in the property market, the report said.

xieyu@chinadaily.com.cn