Stock market bonanza is a worrying sign

Have Chinese shares been flying too high? Or, is the ongoing surge in stock prices just the beginning of a super rally toward a new record?

These questions must be weighing heavily on the minds of not only domestic investors who are opening new brokerage accounts by the millions every week, but also Chinese policymakers who reportedly expect a moderately bullish stock market to help overall economic growth.

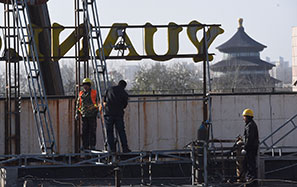

The benchmark Shanghai Composite Index increased 1.54 percent to end at 5,023.1 points on June 5. It was the first time in more than 7 years that the index climbed above the psychologically important mark of 5,000 points since the Chinese stock market crashed from a historic high of 6,124 points in late 2007 to 1,664 points over the span of one year.

While the SCI has risen by more than 50 percent, China's Nasdaq-style ChiNext Index in Shenzhen has soared by over 160 percent this year. The wealth effect is so huge that it is said share buyers in Shanghai on average earned about 150,000 yuan ($24,180) from this bullish market in just the first four months of the year.

But Chinese investors, especially the tens of millions of retail investors should be cautious both against sudden market correction and excessive optimism that the market could maintain this pace forever.

The roller-coaster-like ride Chinese investors have experienced over the past two weeks indicates that the volatility of the stock market will only increase as more people disagree with each other over the current valuation of Chinese shares. The SCI lost about 400 points in just two days at the end of May and plunged 6 percent on May 29 before recovering all losses.

Besides, even though most newcomers have not gone through a complete boom-bust circle of the stock market, they have no reason to expect the Chinese stock market to be an exception to the rule. If the bursting of bubbles in overseas stock markets happens too far to cause concern, the crash of the Chinese stock market seven years ago should remind people of the risks associated with too expensive shares.

For Chinese policymakers, an expanding stock market is more than welcome, especially when the transformation of the economic growth model has intensified without encountering too steep an economic slowdown.

The Chinese economy grew 7.4 percent in 2014, the slowest in more than two decades. And the government has lowered its 2015 target to 7 percent to accommodate slower but sustainable growth marked by qualitative improvement and innovation.

In theory, a booming stock market can help a country's economic transformation at least in two ways: by boosting domestic consumption through the wealth effect of the stock rally and by supporting mass entrepreneurship and innovation through more initial public offerings for start-ups and growth enterprises.

Nevertheless, as the SCI has surged vigorously from about 2,000 points to above 5,000 in just one year and finished at 5,166.35 on Friday, policymakers need to examine the potential risk of stock bubbles as well as the real effect of the country's loose monetary policy.

Given the abundance of reports saying high valuation has prompted entrepreneurs to cash in on their newly listed companies' shares and professors to compete with the stock boom to draw college students' attention in the classroom, policymakers should pay attention to the long-term impact of a runaway stock bubble, which could affect the economy and society both.

Besides, as the United States is positioned to increase its interest rate soon, Chinese policymakers should prepare for unwanted changes in the global financial market that could make the overheated domestic stock market extremely vulnerable.

The author is a senior writer with China Daily.

zhuqiwen@chinadaily.com.cn